If you’ve ever wished to be totally free from debt, then the debt snowball worksheet may help fulfill it. After all, freedom from car payments, student loans, and credit card bills may leave you with at least $800 of extra cash monthly. To make it into a reality, you should start making a debt snowball spreadsheet.

Debt Snowball Worksheet

The debt snowball and avalanche methods involve taking care of each unpaid balance one-by-one. While the avalanche starts with the larger ones, the snowball does the opposite.

It may take a long time, but the little amounts you repay will motivate you to stick to the plan until the end.

What Is The Debt Snowball Method

As we’ve mentioned, the snowball method involves paying off your smaller debts first and repaying increasingly larger ones. First, you must list all your debts in increasing order, excluding mortgages. Specifically, non-mortgage loans are:

- Personal loans

- Credit card debt

- Home equity loans

- Car notes

- Medical bills

- Student loans

- Payday loans

To make it easier, list it in a debt snowball spreadsheet using your computer. A spreadsheet program will make it easier to list your balances. The next step in the debt snowball method is to determine the minimum payment required for each.

Now, your goal is to pay the smallest one as much as you can and to pay the minimum for the other ones. Continue settling your monthly payments until you fully repay your smallest debt. Then, proceed with the next small amount and repeat until all of them are repaid.

How Debt Snowball Works

Using the debt snowball method may seem confusing and daunting, so you may want an example as to how it works. You may also be skeptical and want to see a sample to prove it. If so, you may check this example to understand the method further. For instance, imagine having the following debts:

- $500 medical bill with a $50 payment

- $2,500 credit card debt with a $63 payment

- $7,000 car loan with a $135 payment

- $10,000 student loan with a $96 payment

Using the debt snowball method will involve paying the minimum for all except the medical bill. If you worked on a second job as well, you may have an extra $500 monthly. Now you can be gazelle intense by allocating that cash to your smallest debt. By paying that along with its $50 installment, you may bid goodbye to it in a month.

Then, you may proceed to cut down the credit card debt with the $550 and the $63 minimum, After four months, you have taken it off the debt snowball worksheet as you’ve paid it off! Now, you can take down the car loan by paying $748 monthly. In 10 months, that will be off your debt snowball spreadsheet!

Now, it’s time to take on Sallie Mae by paying $844 a month. Keep at it for 12 months, and soon you can evict off your house with the last of your debts wiped out! Finally, you can give yourself a well-deserved pat on the back for your hard work and sacrifice. In 27 months, you have paid off $20,000 in debt with the help of the snowball method!

The Fastest Way To Get Out Of Debt

Well, it seems faster to pay off the larger debts first as it would save you more money. However, it will discourage you as you won’t see progress early.

It’s important to keep at it until you’re debt-free, and quick wins will help. Keep rolling off the smallest ones first, and you’ll get the momentum to keep going!

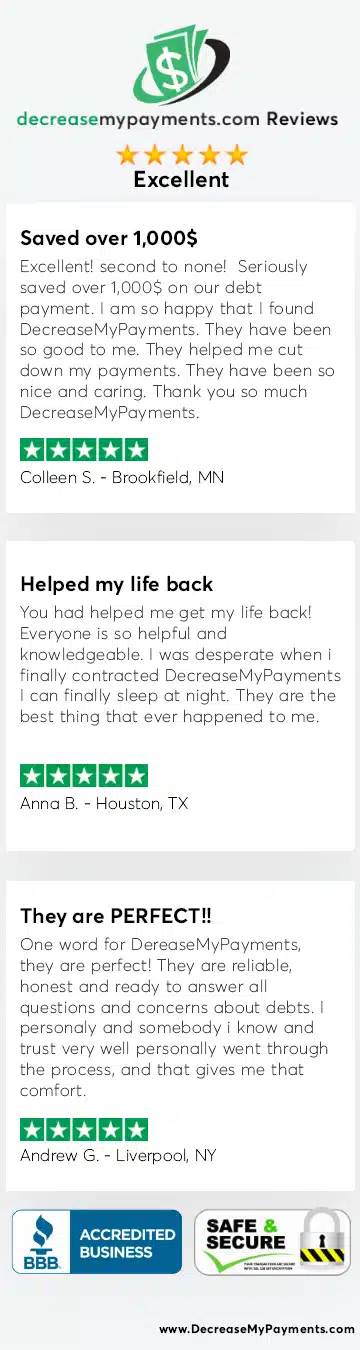

Check if you qualify in two simple steps

- Step 1 –

- Step 2 –

When Do I Plan To Start The Debt Snowball?

If you have an emergency fund of $1,000, then you can start writing your debt snowball sheet. You need it for emergencies such as a flat tire from sinking you further into debt. Then, you can start the snowball method.

Now, organize your debt snowball worksheet by listing your non-mortgage debt from smallest to largest with your spouse, if you have one. Then discuss how you can pay the smaller amounts. For instance, you may look for side jobs or sell stuff you don’t need. Then, follow the steps mentioned earlier, and soon you’ll be free from interest rates and your credit score will show it!

No matter what method you use, the best way out of debt is discipline and hard work. Don’t buy stuff to impress the Joneses. Remember that you don’t need to keep buying stuff to impress people you don’t need with money you don’t have to impress people you don’t like. Live below your means so you can have enough for emergencies.

You may check out blogs for more info regarding the debt snowball and other financial tips and advice. Try a Debt Snowball Calculator to guide you in paying off debt using the snowball method.