To have a healthy financial situation, you must learn how to build credit. Credit is an essential piece of information that helps you avail of vital goods and services.

Thankfully, there are many ways to improve your credit if yours looks unfavorable. Apply the best ways to build credit early, so you can use it when needed.

What is Credit?

Before you get into bolstering credit, you must know exactly what it is and why it’s important. Credit is used to get something you want that you promise to pay later. Americans and others worldwide use it to buy necessities such as food and shelter.

You may even have been using credit for less apparent reasons like applying for a job or getting service for your smartphone.

How Is It Measured?

How you use it is detailed in a document called a credit report. More importantly, it shows your credit rating, a letter grade determined by how you use credit.

In addition, there’s also the Fair Isaac Corporation (FICO) score from the three credit reporting institutions: Experian, Equifax, and TransUnion. Instead of letters, it uses three-digit numbers to gauge your spending habits.

Why Do You Need Good Credit?

Regardless of which rating you use, you need a good score to receive better deals from lenders. After all, the score assures them that you are able to repay their loans.

A good grade allows you to access lower interest rates and lesser restrictions on debts. Understanding what is good credit helps you set realistic targets for improvement. Conversely, a bad one means worse deals and may limit the services available to you.

Check if you qualify in two simple steps

- Step 1 –

- Step 2 –

How to Establish your Credit

Now that you know its significance, you’ll be delighted to know the best ways to build credit. Certain institutions provide services that may help, and you may even ask people you know for assistance as well.

Once you improve that rating, you may find it easier to save money and pay for expenses. Read further to learn how to build credit.

Get a Secured Credit Card

Unlike typical credit cards, these are backed up by a security deposit equal to its credit limit. For example, if the limit is $500, then you need to pay that amount to the card issuer to receive yours. It functions similarly to a regular credit card, but you get your deposit back when you close the account.

By repaying your balances on it punctually, it can help you raise your creditworthiness. After all, on-time payments show creditors that you are likely to pay their loans back. To maximize its use, make sure to only purchase once or twice per month with the card. Also, make sure to repay before the due date to avoid interest.

A secured card is a relatively safe and convenient way to build credit. If you fail to repay your balances on time, the issuer takes your deposit. You only risk funds you’ve already allocated to the card. Some issuers may even allow you to upgrade to an unsecured card once you’ve raised your credit rating high enough.

Become an Authorized User

Another great way on how to build credit is to get your friends and family involved. Specifically, find those with good credit to add you as an authorized user on their cards. This is one of the best ways to build credit because you don’t even need to use or possess their card. Your friend or relative won’t have to worry about their card while helping you become creditworthy.

There are some caveats to keep in mind as an authorized user. First, make sure the card issuer reports to credit bureaus before applying, or it won’t help you start building credit. Next, be prepared to do something in return as an authorized user. Your close relative or friend may not register you easily, so you may need to strike a deal with them.

Get a Co-Signer

Your close buddies and relatives may also co-sign your loans to help you build credit. You may have encountered such a method when taking out a student loan. Co-signers help people to take out loans they won’t be able to have approved by themselves. Having a co-signer will help you take out more loans to repay on time, boosting your credit rating. Consider exploring debt strategy options to find the best approach for your situation.

Make sure to discuss with your intended co-signer thoroughly before proceeding. Both of you must be absolutely certain that you can take on debt. They must repay your loan if you can’t, including any incurred penalties and interest. Furthermore, a sour co-signing incident may ruin your relationships with your friends and relatives, so be careful.

Check if you qualify in two simple steps

- Step 1 –

- Step 2 –

Increase your Credit Card Limit

One more way on how to build credit is to increase your card limit. The ratio of your debts to your limit is called credit utilization, and it is factored into your credit rating. Keeping utilization low will raise your credit score, and a larger limit relative to your balances will help. However, it’s one of the best ways to build credit only if you have good habits on spending.

After all, piling on more debt may lead to increased utilization, making a higher credit limit useless. You should keep your loan-to-limit ratio at 30% or lower, so the card can help boost your credit. Your credit may take a temporary hit when applying for an increased card limit. The card issuer may perform a hard credit inquiry that deducts from your rating

Pay Loans Diligently

As we’ve mentioned repeatedly, paying your bills on time helps you build credit. Ratings rise as borrowers repay their loans on time, so a high score proves your reliable payment history. This assures lenders, motivating them to offer you better deals. Monitor your progress with a debt calculator to see how improved credit affects your repayment options. In fact, it may enable you to access certain services reserved for creditworthy borrowers.

This means you should have a history of on-time payments. Take out minimal and continual loans then pay them back before their deadlines. A credit builder loan is a personal loan that specifically boosts credit.

It is tremendously beneficial for those with poor credit since they are allowed to take one out. Still, diligent payments are highly essential.

Summary

Credit affects your access to vital products and services. This is why you must employ the best ways on how to build credit. Learn how to build credit by applying for credit builder loans or requesting a higher credit limit.

Consult your friendly credit unions or other financial institutions for further assistance. You may also ask your relatives or friends to help as well.

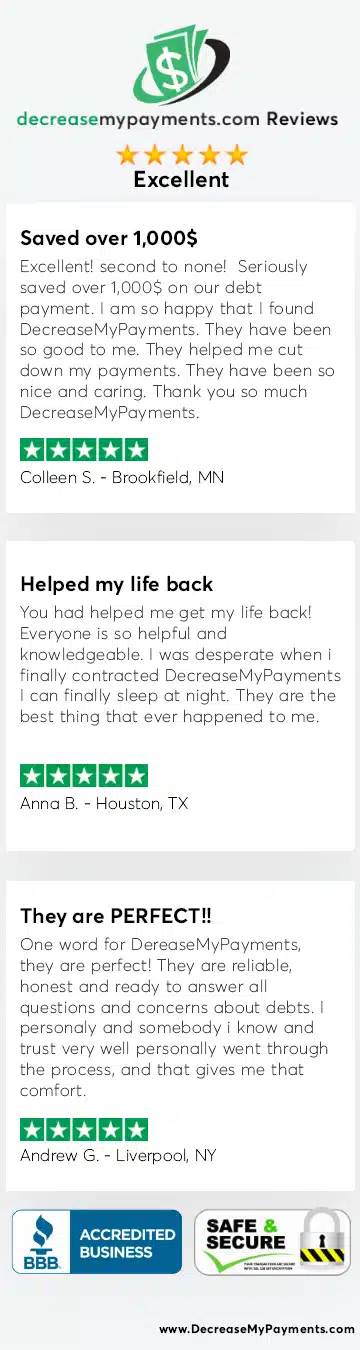

You could also use free resources. People may get free credit scores from certain websites. However, only transact with reputable institutions to avoid identity theft and other scams. For professional credit-building guidance, consider reputable debt management services that can help improve your overall financial profile.