Here Are the Five Options For Becoming Debt Free

These money management solutions could be the ones you need depending on your financial situation.

Whether you had to shoulder a medical emergency or take on student loans, these solutions may work along with proper spending habits. Nevertheless, you should know how each works, so you can choose the appropriate one.

Debt Relief Programs

WHAT IS IT?

PROS

CONS

Debt Settlement

This involves asking a company to negotiate with your lender to lower the amount you owe. Once approved, you will then send your payments to that company which will then send it to your lenders.

- You may save more by paying minimally

- You will only have a singular monthly program deposit

- You may pay your debts faster compared to making minimum payments

- You may receive frequent calls for debt collection

- Your credit rating may lower

- Temporarily The results you get may vary

Debt consolidation

This involves borrowing a lump sum to pay off your debts simultaneously. Learn more about what is debt consolidation to understand if this strategy fits your needs. You will then repay it with lower interest in monthly installments until settled.

- You will only handle one specified monthly payment.

- You may even negotiate flexible terms

- You won’t need to worry about your credit history

- You may need good credit

- Your principal won’t be reduced

- The results you get may vary

Credit Counseling

This involves a credit counseling agency reviewing your finances, discussing lower rates with your creditors, and making a debt management plan you must follow.

- You will pay in monthly installments

- You will pay lower fees and rates

- You won’t be frequented by collection calls

- You may be identified by other lenders as a credit risk.

- This won’t lessen your principal debt

- A DMP may require you to close your credit card, save one for emergencies

Bankruptcy

This is a legal procedure where your assets are used as payment for your debts. The most common ones are called Chapter 7 and Chapter 13. Afterward, you are completely relieved of those obligations.

- If you filed for Chapter 7, your unsettled balances could be cleared

- Your creditors won’t be allowed to collect

- This takes only 3 to 6 months

- You may carry long-term, severe damage to your credit

- You may lose your credit cards

- You may find it hard to qualify for Chapter 7

Do-it-yourself

You get to use all the online and offline tools available to manage your debts on your own.

- If you filed for Chapter 7, your unsettled balances could be cleared

- Your creditors won’t be allowed to collect

- This takes only 3 to 6 months

- If you filed for Chapter 7, your unsettled balances could be cleared

- Your creditors won’t be allowed to collect

- This takes only 3 to 6 months

Debt Settlement

Typically called debt resolution or negotiation, these are best for those who are on the brink of bankruptcy. If you aren’t able to pay your high-interest debts, a debt settlement company may just be able to help.

Settlements are negotiated by these companies in order to reduce unpaid balances. Unsecured debts like credit card balances are allowed but not secured ones like auto loans. After approval, monthly payments are sent to an “escrow account” specifically for the settlement. Once completed in 24 to 48 months, then that special account is closed.

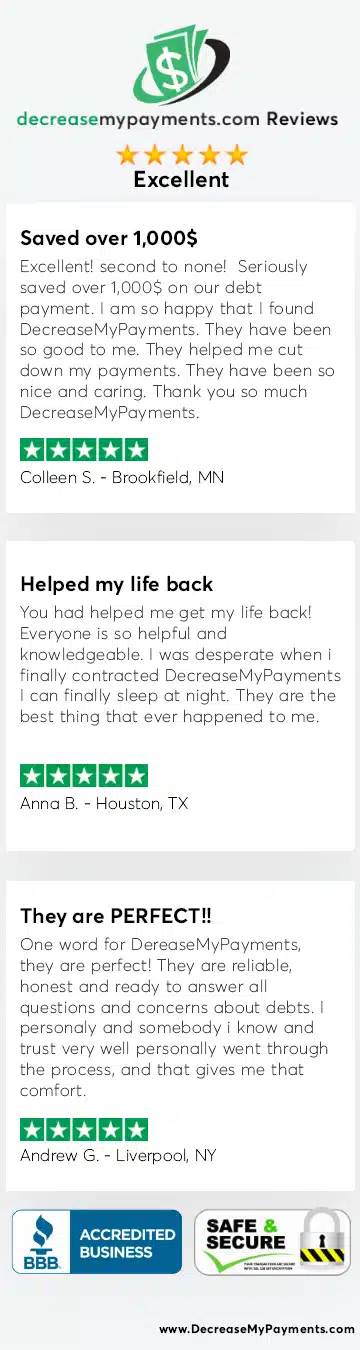

For the best results, you may want to try our Decrease My Payment Debt Strategy which has resolved over $9 billion in debt. Learn the complete process in our debt settlement guide. The program isn’t one-size-fits-all, so we will custom-make the program to your financial situation. We ensure the highest opportunity for success, and we won’t charge any fees until a debt settlement has been made.

Credit Counseling

This involves consulting a debt management company so you may negotiate a lower payment plan with your lenders. A credit counselor will analyze your financial situation, suggest a debt management plan, and offer free financial education materials. Success with any plan requires developing better money habits for long-term financial health.

While this may seem like a settlement, it doesn’t lower the initial amount you owe.

Debt Consolidation

Another method on how to become debt-free is consolidation, settling your unpaid balances with a personal loan that has a lower interest. You may transfer them to a bank transfer card with a 0% interest rate for an introductory period.

Otherwise, you may take out a home equity loan. Consolidation loans are one of the riskiest debt relief programs, so make sure to research a company thoroughly beforehand.

Bankruptcy

When all else fails, this is the nuclear, last resort for settling your debts. Bankruptcy cases involve absolving you from all your debts but at the cost of a decade’s worth of credit report damage. These are processed in bankruptcy courts, where two types of bankruptcy are processed.

Under bankruptcy laws, Chapter 7 bankruptcy relieves you from all your debts, excluding student loans and taxes. Worse, your assets may be sold to cover them. On the other hand, Chapter 13 of the bankruptcy code may still require lower payments for your debts. It’s also more expensive to file, but Chapter 7 is more difficult to qualify for.

Check if you qualify in two simple steps

- Step 1 –

- Step 2 –

Do It Yourself

If you don’t have extra money for debt relief programs, this is your way on how to be financially free. This involves using every offline or online resource available, such as debt calculators or books. You will also have to plan how to take on your debt by yourself.

However, this can be a long, grueling process as you may take decades to settle all your payments. If you merely complete minimum payments, your interest may grow too large to pay off. We recommend asking for professional advice to avoid further financial problems.

Summary

There are many debt-relief programs out there for your financial situation. However, the best money management method is to spend wisely and pay punctually.

This will help you save for emergencies, avoid debt, and safeguard your credit rating. If you need help, don’t hesitate to ask professional debt management specialists who can provide personalized strategies for your unique financial situation.