So you’ve graduated, but dealing with student loans feels like its own full-time job. Between multiple servicers, confusing repayment plans, and ballooning balances, it’s no wonder managing student debt causes headaches.

As someone who recently walked in your shoes, I know the stress all too well. But have hope – consolidation could be your solution. Stick with me as I guide you through the process. By the end, you’ll have a fresh perspective and a simpler way forward.

Student Loans in the US

As costs of higher education continue rising at an unsustainable rate, more and more students are taking on significant debt to finance their education.

According to the latest statistics, total student loan debt in the U.S. now exceeds $1.7 trillion owed by over 45 million borrowers. For the graduating Class of 2020, the average debt burden was an eye-watering $37,014. No doubt you can relate to these startling numbers if you’re among the millions struggling under a heavy yoke of student loans.

While taking on debt is an unfortunate necessity for many seeking to better their futures through college or vocational programs, unfettered increases in tuition year after year have pushed student borrowing to crisis levels for both individuals and society as a whole.

No longer limited to just private and graduate school debts, undergraduates are graduating with higher loan balances than ever before. This ongoing student debt catastrophe poses serious risks if left unaddressed, threatening both individual financial security and macroeconomic growth for years to come.

Thankfully, help exists for drowning student loan borrowers through consolidation options offered by the U.S. Department of Education. By combining multiple loans into a single new debt with a fixed interest rate, consolidation offers a viable lifeline to bring some order and simplicity back to an otherwise chaotic situation.

In the following guide, we’ll break down exactly what consolidation entails, its potential benefits, and how to start navigating your way through the process. My hope is this serves as a helpful first step on your journey to finally taking control of your student loans.

Understanding Consolidation: Your Loans Simplified

At its core, student loan consolidation combines all your eligible federal education loans, both undergraduate and graduate, into one simple loan with a single monthly payment.

The interest rate on your new consolidation loan will be a weighted average based on the interest rates of the loans being consolidated, rounded up to the nearest one-eighth of a percent.

This has a couple key effects: firstly, it streamlines multiple payments from different loan servicers into one single, convenient payment each month.

Secondly, if any of the loans consolidated carried higher variable interest rates, the fixed rate from consolidation can potentially save on interest costs over the life of the new loan. Even if rates don’t decrease much, the simplicity and organization consolidation provides is a major relief.

In addition, consolidating resets the age of your loans, re-starting the repayment term from zero. This extends the maximum repayment period, which lowers your monthly payment through extended amortization.

It also allows you to qualify for potential lower payment options under an income-driven repayment (IDR) plan tied to your earnings and family size. Now let’s dive deeper into weighing the pros and cons of student loan consolidation in different scenarios:

Pros and Cons: When Does Consolidation Make Sense?

As with any major financial decision, consolidation is not always the optimal choice and its benefits must be carefully considered against potential tradeoffs specific to your situation. Some general pros and cons to keep in mind:

Pros:

- Simplifies multiple payments into a single monthly amount from a single servicer

- Lowers monthly obligations if interest rates decrease for consolidated loans

- Often qualifies for more affordable IDR plans like Pay As You Earn (PAYE)

- Resets repayment term to potentially shave years off the loan

- Interest charged only on principal, avoiding multiple accumulated interest charges

- No fees to consolidate federal loans

Cons:

- In some cases, interest rates may actually increase if older loans had lower rates

- Any progress toward loan forgiveness like Public Service Loan Forgiveness (PSLF) resets to zero

- Consolidation can extend loan term up to 30 years, increasing total interest costs

- Gives up right to change repayment plans in the future without re-consolidating

- Private loans and federal Family FED Loans cannot be consolidated

Clearly, consolidation is most advantageous when monthly payments are expected to decrease, such as for those pursuing IDR, PSLF, or with some higher interest federal loans included. The next section analyzes these scenarios more closely to help determine if consolidation makes financial sense for your unique situation.

Targeting the Right Options: Comparing Consolidation and Refinancing

Often confused as identical, consolidation and refinancing are in fact two distinct strategies with differing goals. Let’s compare the key differences for clarification:

Consolidation applies solely to federal student loans governed by the Department of Education’s program rules. By consolidating, you maintain access to benefits like IDR plans tied to income, deferment/forbearance if facing financial hardship, and potential future student loan forgiveness programs (e.g. PSLF).

However, interest rates are fixed, and resetting repayment extends total repayment time and overall costs. Consolidation preserves federal benefits at the expense of higher rates and longer repayment in some cases.

Refinancing, on the other hand, is an option for both federal and private student loans. It involves taking out a new private loan to pay off existing loans – often at a lower combined interest rate. Refinanced loans have variable rates set by private lenders, not the government.

This can lower monthly costs but comes at the costly risk of forfeiting all future access to federal programs like IDR, deferment/forbearance, and PSLF forgiveness. Refinancing only makes sense if you have great credit, don’t need federal benefits long-term, and can get significantly lower rates to offset losses.

The bottom line? Carefully weigh consolidating federal loans versus refinancing if credit allows – consolidate if needing affordability programs, refinance only if rates drop substantially and you don’t qualify or plan to use federal benefits. Let’s move forward to analyze optimal repayment strategies next.

Maximizing Repayment Plans: Income-Driven Options Explained

As alluded to earlier, one of the primary advantages of consolidating is unlocking access to various income-driven repayment (IDR) plans. These programs tie your monthly loan payment directly to your income and family size, serving as an indispensable lifeline for millions of lower-paid public service workers and others saddled with immense loan debt.

The main IDR options available through consolidation include:

- Revised Pay As You Earn (REPAYE) – Caps payments at 10% of income and forgives remaining balance after 20-25 years

- Pay As You Earn (PAYE) – Caps at 10% and forgives after 20 years, only for loans taken out after 2007/08

- Income-Based Repayment (IBR) – Caps at 15-20% and forgives after 20-25 years

All three actively track your income/family size each year, recalculating the affordable payment amount accordingly. Any remaining balances are forgiven tax-free after completing program terms, provided qualifying employment. This long-term forgiveness potential, paired with low(er) monthly dues, make IDR plans a huge win for millions relying on them.

So in summary, consolidating student debt allows access to otherwise unavailable programs to keep payments down, especially for low earners needing extended relief. Let’s explore how to smoothly complete the consolidation application next.

Applying for Consolidation: Gather Documents and Get Approval

Now that you understand the wide-ranging benefits of student loan consolidation, it’s time to dive into the actual application process through the Department of Ed’s website – StudentAid.gov. Here are some key steps and tips to focus on:

Create an FSA ID as a dual username/password for signing forms electronically if you don’t already have one. This serves as your legal digital signature.

Fill out the Consolidation Application, providing personal details, loan specifics, and contact information for your loan servicers – have this information ready to paste in.

Choose a Repayment Plan that works best for your circumstances – IDR plans likely offer lowest monthly payments.

Electronically “Sign” your application by entering your FSA ID, reviewing all information, and confirming submission.

Expect up to 60 days for approval processing, during which your servicers may request additional documentation as needed to certify eligibility.

Be prepared with: pay stubs, tax returns, documentation of employment, proof of annual income/family size for IDR plans. Upload, fax, or mail these promptly if asked to avoid delays.

And that’s it! Applying is a simple online process when prepared and organized beforehand. Your new consolidated loan will be disbursed by a federal loan servicer, setting the path for clearer student debt management ahead.

Life After Consolidation: Tips for Smooth Sailing

Once approved, stay on track with your new, simplified consolidated loan through vigilance and proactive communication with your new federal loan servicer.

Your regular monthly payments will draft automatically, but don’t become disengaged from the repayment process altogether. Here are some additional tips for smooth sailing:

- Update servicer if contact info like phone/address changes

- Confirm income/family details annually for IDR to keep payments accurate

- Contact servicer pronto if experiencing financial hardship for options like deferment/forbearance

- Ask servicer about special programs like one-time reset of payments if prior amounts too high

- Consider high-deductible healthcare plans if on IDR for healthcare costs to lower “income”

- Refinance privately

Setting Yourself Up for Student Loan Forgiveness

As referenced earlier, one of consolidation’s major incentives is unlocking access to various student loan forgiveness programs. Two options in particular stand out as worthwhile to target: Public Service Loan Forgiveness (PSLF) and income-driven repayment (IDR) forgiveness.

Public Service Loan Forgiveness (PSLF) is designed to encourage individuals to pursue long-term careers in public service by forgiving any remaining federal student loan balance after 10 years of qualifying repayments under an IDR plan while working full-time for eligible government or nonprofit employers. This powerful incentive is one of the biggest perks of consolidating federal loans rather than refinancing privately.

To maximize chances of PSLF approval, be sure to:

- Carefully review the PSLF Employer Certification Form to ensure your employer qualifies

- Consolidate federal loans and sign up for an IDR plan immediately upon graduating/starting work

- Submit Employment Certification annually or when changing PSLF-qualifying jobs

- Make 120 on-time payments over 10 years under an IDR plan for full forgiveness

- Keep detailed records of employment, payments made, rejection/approval notices

IDR forgiveness comes into play after 20-25 years of repayments under PAYE, IBR or REPAYE plans. If any loan balance remains at that point, it is canceled tax-free. This option provides a substantial long-term safety net for those committed to lower IDR payments over an extended period, even without PSLF career options.

Some key tactics for maximizing IDR forgiveness include:

- Recertify income/family size annually for lowest payments

- Consider income-driven strategies like extra pay deductions, retirement contributions

- Keep records in case payments aren’t properly adjusted over the years

- Make sure to apply for recalculation if financial circumstances change

- Mark calendar for forgiveness finish line 20-25 years out!

Combining consolidated student loans with the robust forgiveness programs available is a prudent strategy for many. With diligent record-keeping and optimized repayment planning over time, non-payment of remaining balances becomes a reality. Let’s explore managing through life’s ups and downs next.

Applying Consolidation During Financial Hardship

No matter how thoroughly we plan our finances, unforeseen circumstances like unemployment, disability, or family crises can often interfere with even the most carefully managed budgets.

Rest assured, safety nets exist for federal loan borrowers facing extreme temporary hardship through deferment and forbearance options.

Deferment is a temporary postponement of payments through the Department of Education if you meet their eligibility criteria. It may be granted for economic hardship or return to school. No interest accrues during an in-school deferment, but unpaid interest does for other types.

Forbearance is similar but interest continues to accumulate on unsubsidized and underlying portions of subsidized loans. It has more lenient eligibility rules than deferment and can be used for economic hardship or medical issues.

Both programs provide 6-12 month relief windows that can be extended further if the financial constraint persists. Early communication with your loan servicer is essential to understanding available relief options and putting them in place expediently. Consolidation ensures continued access to these vital crisis stopgaps as part of federal loans.

In closing, student loan debt can feel inescapable. But with awareness and empowering yourself through clear-eyed choices like consolidation, individuals regaining control over payments is wholly achievable in today’s supportive regulatory climate. Here’s to your brighter financial future ahead.

Managing Student Loans Through Life Transitions

While entering repayment is a major life transition, it’s certainly not the only transition that borrowers face in the coming years. Marriage, growing families, career changes, medical issues – all have potential to impact your financial picture and student loan strategy. Thankfully, flexible options are available within consolidation to adapt.

Marriage & Divorce

Upon marriage, both spouses’ incomes and debts combine under programs like IBR/PAYE. But post-divorce, only the responsible borrower is counted. In both cases, proactively recertifying your family size is critical for accurately setting minimal payments.

Starting a Family

Adding dependents increases household size for IBR/PAYE calculations, possibly reducing your payment further. Be sure to recertify annually or when a child is born/adopted so your lowest amount is applied going forward.

Job Loss or Career Change

Unemployment deferments and forbearance options exist within consolidation to press pause on payments for temporary hardship. If a new career means lower wages long term, also recertify your income for IDR plan recalculation.

Return to Higher Education

Ask your consolidation servicer about deferment options specifically for enrolling in further degree or certification programs part-time or full-time. Some allow suspension of payments interest-free during re-studying.

Health Issues & Disability

Temporary/permanent forbearance may be approved if disability or serious illness interrupts employment or your ability to pay. Contact servicers promptly about available relief programs during medical crises.

By proactively handling changes and keeping open lines of communication, borrowers keep consolidated loans flexible through hardship patches. With time and care, you’ll come out even stronger.

Looking to the Future: Conclusion and Beyond

Hopefully this guide has helped alleviate some confusion around the complex student loan landscape and outlined clear paths for action through consolidation.

Simplifying your payment process, strategically assessing forgiveness programs, and staying vigilant opens doors to finally solving your debt challenge over the long haul.

Many additional resources exist to support you as life progresses, from specialized career counselors to nonprofit advocacy groups. At every step, remember – you are not alone in this journey. Continued education, patience, and persistence will serve you well.

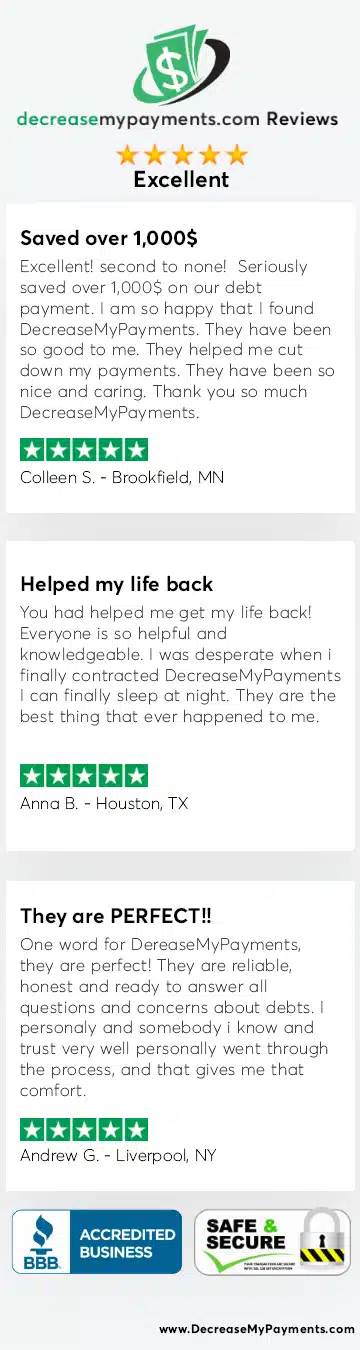

If you find consolidation aligns with your goals, waste no time getting started at DecreaseMyPayments.com. A single, affordable monthly payment could be just around the corner.

And should any other questions arise down the road, free consultation is always here to help map out the best strategy for your unique situation. You’ve come so far – I have no doubt brighter financial days are in your future. Keep moving forward!