It’s no secret that many struggle under the heavy burden of credit card debt. Feeling overwhelmed by months or even years of accruing interest can leave you hopeless about ever getting out from under the mountain of bills.

However, there is light at the end of the tunnel—with smart planning and perseverance, you can gain control of your finances once more.

In this article, we will explore debt reduction strategies, credit card interest negotiation tactics, budget planning tips, the benefits of debt consolidation, and signs that financial counseling may help.

By developing healthy financial habits and chipping away at what you owe, achieving financial freedom is absolutely within reach.

Here are proven methods to pay off credit card debt that can help you regain financial control.

Understanding Your Debt: The First Step to Financial Freedom

The old adage rings true: you can’t improve what you don’t measure. Getting a clear picture of your total debt load is the first milestone on the path to repayment.

Comb through recent statements from all your credit cards and loans to tabulate what you owe. Are you surprised by how high the balances have climbed? Taking stock provides motivation to change harmful spending patterns.

Recording debts in a spreadsheet allows you to see monthly minimum payments, interest rates, and due dates at a glance. Understanding what constitutes good credit can motivate you to improve your financial standing. Color coding accounts by priority (e.g. highest rates in red) illustrates where to focus energy.

Debt tracking apps perform these functions automatically; many even sync with bank accounts for up-to-the-minute oversight. Knowing your numbers empowers better financial decisions and goal setting going forward.

Creating a Sustainable Budget

Once aware of outstanding liabilities, it’s time to create a realistic monthly budget. This spending plan accounts for necessities like housing and groceries, then allocates what’s left to paying down principal.

List fixed expenses, variable costs, and discretionary line items to avoid lifestyle inflation as balances shrink. Budgeting apps generate spending categories and graph progress over time for motivation.

Budgets work best when they reflect your actual earnings and constrain impromptu purchases. Build in a little flexibility too so you don’t feel deprived. Paying more than minimums yet staying on track financially feels empowering—a true sign of gaining control over credit card debt.

Stick to the budget for consistent debt reduction, avoiding burnout from an overly strict formula. Progress builds momentum to continue chipping away at what you owe.

Tackling High-Interest Rates Head-On

Outstanding credit card debt grows fastest under the brutal force of compound interest. Thus, negotiating lower APRs ought to be job number one. Use a debt calculator to visualize your payoff timeline and potential savings.

Review recent statements for contact information, then request a rate reduction by phone or letter—be prepared to provide your full payment history and any life changes affecting finances. Economic uncertainty may have lenders willing to negotiate to keep customers.

As an alternative, balance transfer credit cards levy 0% intro APR periods allowing debt freedom from interest for up to 21 months. Carefully consider associated fees before applying. Paying more than low minimums each month devotes funds fully to principal during the 0% window.

Another angle is rolling high-rate cards into lower-interest personal loans, but these consolidate existing debt rather than eliminating it outright.

Whatever tactic you choose, avoid impulse spending that piles on new balances. Increased payments win the war on debt faster than paltry minimums. Stay laser-focused on reducing principal to rid yourself of the shackles of credit card debt for good. A debt-free future is worth the effort of negotiating strategic reductions today.

Exploring Debt Consolidation Options

If interest reductions don’t offer sufficient relief alone, consolidating multiple accounts into one monthly payment deserves consideration. Personal loans and credit counseling programs typically reduce rates, simplify obligations, and extend repayment terms compared to credit cards. Learn more about debt consolidation options to determine if this strategy fits your situation. However, be wary of debt settlement scams that charge hefty fees upfront without guarantee of negotiated savings.

Reputable non-profits like the National Foundation for Credit Counseling provide free financial assessments and consolidate creditors at lower total interest. Counselors teach practical budgeting too. Alternatively, a low-rate personal loan from your bank could roll multiple cards into its lower fixed rate. Just avoid incurring new charges that undermine consolidation progress.

As with any debt solution, consolidation carries risks if you don’t change spending behavior. Make sure the program maintains positive credit reporting while you meet payment obligations to maintain credit scores. Anecdotes from fellow debtors who succeeded with counseling or loans inspire hope that you too can regain control.

Seeking Professional Help: When and How

If interest payments alone exceed monthly earnings or you’ve neglected bills for over 90 days, the situation calls for urgent guidance.

Non-profit credit counseling services intervene on behalf of overwhelmed consumers—counselors negotiate directly with creditors to temporarily lower interest or waive fees so repayment becomes manageable.

People enroll by phone or online after completing a financial worksheet assessing income, debts, and expenses. Expect counselors to design a customized debt management plan around a single affordable monthly payment stream.

Their monthly calls keep you accountable, while discharge letters and lower costs relieve stress. Credit reporting stays positive as long as the program succeeds. Give counseling sincere effort, follow the plan as directed, and relief arrives even faster. For some, this expert intervention saves homes from foreclosure or offers a fresh start after bankruptcy.

Building Healthy Financial Habits for the Future

Once past the thick of repayment, maintaining results demands diligence. Schedule quarterly financial checkups to address minor money issues before they return to crisis levels.

Automate savings toward emergencies, then shift funds there upon reaching zero balances. Prioritize investments for long-term goals rather than unreliable get-rich-quick strategies.

Paying yourself first by directly depositing savings each pay period prevents lifestyle inflation that risks future debt relapses. Continuing creditor relationships maintains favorable terms and scores.

Consider lowering credit limits as confidence grows to limit damage from potential theft or fraud. Healthy habits prevent financial stress and ensure the prosperity achieved through hardship sticks for good. Financial freedom remains within reach through prudent stewardship.

In conclusion, mounting credit card debt need not spell doom. With hard work and dedication to reducing balances through strategic negotiation, budgeting, or counseling services, unpaid obligations become manageable.

Financial health restores through eliminating accrued interest charges over time. While rebuilding creditworthiness takes effort, each step forward chips away at what once felt an insurmountable mountain.

Staying accountable and maintaining new money mindsets cements results permanently. The future remains bright for all committed to gaining control of their finances once and for all.

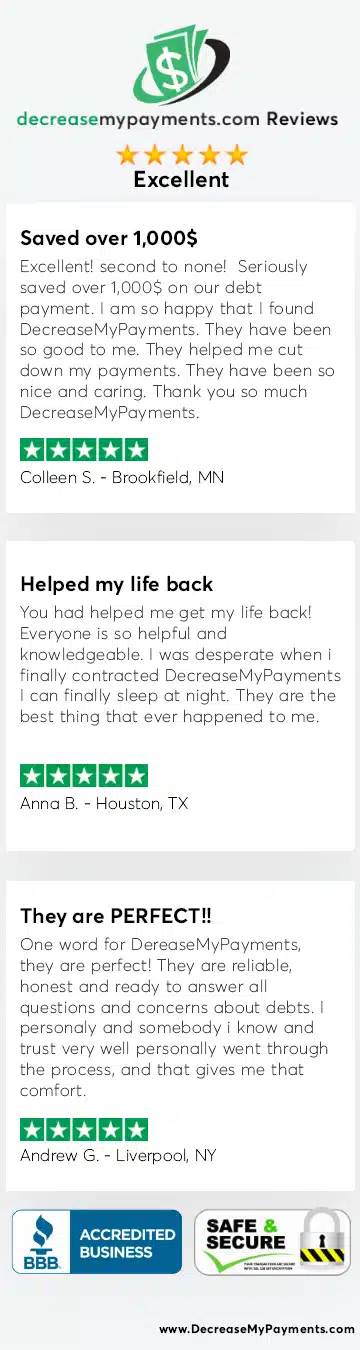

Feeling overwhelmed? Check out our free resources at Decrease My Payments for additional debt reduction strategies, calculators to analyze payment options, and related guides. For expert assistance, consider our professional debt reduction services to accelerate your journey to financial freedom.

We also offer inexpensive credit counseling services and debt management programs. You have taken the first step by committing to education—the rest depends on consistent effort each month. But take heart—with small, steady improvements, financial freedom comes into focus.

In summary, achieving lasting debt repayment demands realistic planning, tactical redirection of funds to principal, and maintaining optimized money habits long-term.

This comprehensive guide laid foundations for success. Use the tips, tools, and solutions outlined to commence your journey out of credit card debt maze towards financial stability. You’ve got this!

Negotiating Lower Interest Rates: Your Key to Reducing Debt

Implementing strategic interest rate reductions on high-balance credit cards represents low-hanging fruit for faster debt elimination. Contact issuers to request lowered APRs based on a strong payment record and any life changes straining your finances.

As an alternative, 0% balance transfer credit cards deliver 18-month interest holidays if used responsibly. Avoid accruing new charges that undermine repayment progress whatever approach you take—stay laser focused on paying down existing liabilities to rid yourself of credit card debt for good.

The Ultimate Guide to Debt Consolidation: Pros, Cons, and How-Tos

Juggling minimum payments across multiple high-interest cards feels hopeless. Consolidating balances via a lower-rate personal loan or credit counseling program simplifies obligations into one affordable monthly payment. However, make sure any program maintains positive credit reporting while in the program to avoid long-term scoring damage.

Anecdotes of fellow debtors succeeding with reputable non-profits like credit counseling inspire that you too can regain control through consolidation if paired with budgeting diligently. Just beware sketchy debt settlement firms that charge hefty upfront fees without guarantee of real savings.

Transforming Your Financial Health: Budgeting and Beyond

Maintaining money management changes and healthy habits guards hard-won financial gains. Build upon momentum from debt freedom by automating emergency savings.

Prioritize investing for goals beyond get-rich-quick schemes, lowering credit limits as confidence in responsible use grows. Schedule quarterly financial tune-ups and shift discretionary funds there first to avoid creeping back into crisis.

Continuing prudent creditor relationships preserves favorable terms. With proactive stewardship, years of interest-fueled debt lose power permanently—your prosperous future takes root.