If you’re having trouble with money, here are 7 tips to ditch debt. After all, credit card debt repayment and other monthlies may be a drag on your finances. Luckily, there are things you can do in a pinch to sort them out. Through diligence, discipline, and these steps, you can be debt-free!

1. Try the Snowball Method

First, you may try the snowball method, a do-it-yourself way to pay off debt. It involves paying your balances in descending order, starting with the smallest one. To avoid late penalties, you must pay the minimum for your other monthly payments as well. Once you paid off your first balance, you must then repay the next small balance.

You may think this technique is lengthy and arduous. Alternatively, the debt avalanche method that starts with larger debts instead may seem more expedient. However, the avalanche may frustrate you as large balances take ages to save for. On the other hand, you see quick, incremental changes with the snowball, so you may commit to it longer.

2. Pay Above the Minimum Payment

Merely paying the minimum on your credit cards and other personal loans may hurt your long-term finances. After all, minimum payments don’t deduct from your interest, so you eventually end up paying off a huge interest.

Paying above that threshold lowers your credit utilization, so it may reflect favorably on your credit score.

3. Get a Part-Time Job

Of course, a great way to get out of debt is to have more money for payments. You may engage in a side hustle in order to earn additional funding. Despite being temporary, a part-time job may help you earn more to ditch debt.

Thankfully, there are various online jobs you may take on without taking too much time.

4. Change Your Lifestyle

Most people are dire financial situations due to unfettered spending. While some have to take out huge loans for emergencies, more people pay for unnecessary stuff and services. That’s why the best debt reduction strategy is psychological. By changing unruly money behaviors and keeping good ones, you can truly escape debt and stay away from it!

You must develop a mindset that prioritizes needs over wants. There are many things vital to your life, such as groceries and utility bills. List down the expenses you truly need and divert most of your spending to them. Then, classify your other expenses as “wants,” and abandon those that you can live without.

By removing unnecessary expenses, you increase the extra money that may pay for debts instead. These may include subscriptions to video streaming services or memberships that are redundant or unused. More importantly, rein in the urge to buy expensive items like the latest smartphone or costly vehicle.

Check if you qualify in two simple steps

- Step 1 –

- Step 2 –

5. Make a Budget (and Stick to It!)

Most importantly, you should put your plans to get out of debt on a written budget. It guides your spending towards financial freedom. Usually, it involves distinguishing between necessities and frivolities. Nevertheless, there are budgeting techniques that guided many to ditch debt.

One of them is the 50/30/20 method that allocates payments according to necessity. Like most budgets, it starts with determining your income after being deducted by your taxes. This after-tax amount will be allocated to your various expenses. As we’ve mentioned, you must now classify your expenses as “needs” or “wants.”

Dedicate 50% of it to your basic needs like utilities and groceries. If half your income is insufficient, you will have to take from your 30%. This is supposedly for the stuff you want to buy and for unforeseen expenses. After all, it wouldn’t be sensible to not enjoy your hard-earned cash.

Lastly, the remaining 20% is reserved for your debts and other loans. Like the 30% allocation, it serves as a buffer for emergencies and extra payments. Most importantly, you must commit to your written budget. Resist the urge to impulse buy and stay focused on your written plan.

6. Shop Smart

To get out of debt, there are frugal tactics that you may apply to your daily spending. For example, buying cheaper alternatives to your groceries may help save money. Purchasing items in bulk and using coupons may help you save more as well.

You can ditch debt forever by not accruing more of it, spending only on necessary items.

7. Consider a Balance Transfer

If you simply have too much debt, you may want to perform a balance transfer. This aims to simplify and facilitate debt payoff by replacing several payments with high interest with a singular sum with a lower interest rate. It involves using a debt consolidation loan to pay the total with a lump sum.

Better yet, some balance transfer cards offer a 0% introductory period lasting a year. The absence of interest may help you pay back the principal faster. However, make sure to completely pay it off before the intro period ends. After that, the card will start to charge interest, sinking you further into debt.

Unfortunately, those with poor credit may find themselves offered the highest interest rates. Financial institutions check credit reports, favoring those with better credit. If you have bad credit, you may ask someone to co-sign, so you can take out better loans. Also, you may try building your credit beforehand.

Summary

There are many ways to ditch debt, such as performing balance transfers or getting part-time work. However, how you use these to get out of debt will totally depend on you. The best way to better your financial situation is by living within your means. Cultivate healthy money habits to ensure your financial freedom!

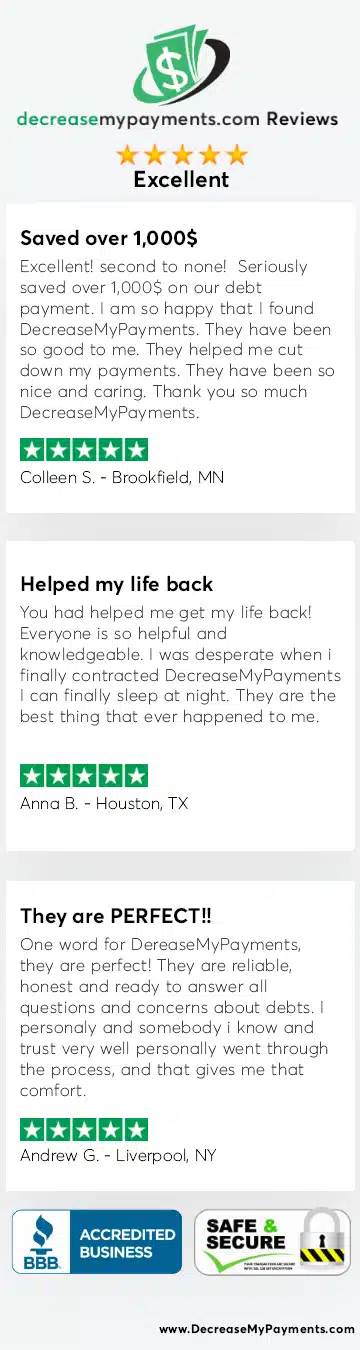

If you’re still struggling, you may want to consult professional help. You may go to a credit counseling company for a debt management plan. Also, there are debt settlement companies that can help reduce your debt. Check all your debt management options, especially for special payments like student loans.